More in Business

Globe Telecom and Nokia Launch Ultra-Fast 5G mmWave Network in the Philippines

Globe Telecom, in partnership with Nokia, has officially launched its 5G mmWave network in the Philippines, introducing ultra-high-speed wireless connectivity that rivals fiber-optic broadband without the need for physical cables. The new network delivers fiber-like speeds reaching up to 4.3 Gbps, set to transform broadband experiences and support mission-critical communications nationwide. Successful field tests conducted in Zamboanga City demonstrated the network’s impressive capabilities, maintaining speeds of 4.3 Gbps at a distance of 2.1 kilometers and nearly 1 Gbps at nearly 9 kilometers, even under challenging geographical conditions. The Philippine Marines have become the first to utilize this cutting-edge technology, enhancing their national security communications. Lt. Col. Nepthalie Papa expressed appreciation for the collaboration, stating, \"We are grateful to Globe, our long-time partner, for continuously supporting the Marine Battalion Landing Team-1 with reliable communications solutions. Through Globe’s commitment to innovation, we have strengthened our connectivity even in the most challenging environments.\" Gerhard Tan, Globe’s Senior Director for Technology Strategy and Innovations, highlighted the broader implications of the deployment, saying, \"At Globe, we’re always looking ahead, pushing the limits of what’s possible in connectivity. The success of our 5G mmWave and Wi-Fi 7 deployment with the Philippine Marines proves that advanced connectivity can transform mission-critical operations. Beyond defense, this technology lays the groundwork for a truly digital and connected Philippines.\" Currently operational in Zamboanga City, Quezon City, and Rizal, Globe Telecom plans to expand the 5G mmWave network to both urban and rural areas. The technology promises to not only elevate internet speeds but also enable private 5G networks catering to industrial automation and other advanced applications, marking a significant advancement in the country’s digital infrastructure.

Business

|2 min read

NBA Investigates Multiple Teams Including Lakers Over Illegal Gambling Allegations

The Los Angeles Lakers are among several NBA franchises asked to submit documents and records as part of an ongoing federal investigation into illegal gambling activities within the league. According to reports, about a dozen Lakers staff members, including assistant trainer Mike Mancias and executive administrator Randy Mims, are cooperating with the inquiry. It is important to note that being contacted does not imply any wrongdoing by those involved. A spokesperson for the NBA stated, \"The NBA engaged an independent law firm to investigate the allegations in the indictment once it was made public. As is standard in these kinds of investigations, a number of different individuals and organizations were asked to preserve documents and records. Everyone has been fully cooperative.\" This probe gained heightened attention due to the involvement of LeBron James, now in his seventh season with the Lakers, who was reportedly the subject of an attempt to sell confidential information concerning his game participation. The investigation originated from a federal indictment last month targeting illicit gambling operations connected to NBA insiders. Notably, former player and assistant coach Damon Jones was arrested for allegedly trying to sell non-public information regarding James sitting out a 2022-23 game against the Milwaukee Bucks. Additional arrests include Portland Trail Blazers head coach Chauncey Billups, implicated in rigged poker games, and Miami Heat guard Terry Rozier, accused of providing a friend with insider information to place bets exceeding $200,000. The league continues to collaborate fully with federal authorities as the investigation unfolds, emphasizing its commitment to maintaining the integrity of the sport.

Business

|2 min read

Erik Esperanzate and Nicole Andaya Triumph at Inaugural 5150 FAB Triathlon in Bataan

Erik Esperanzate and Nicole Andaya emerged as the champions at the debut 5150 FAB Triathlon held in Mariveles, Bataan, on Sunday, demonstrating their exceptional cycling prowess on a course renowned for its steep and technical ascents and descents.\n\nAt only 18 years old, Esperanzate overcame a less-than-ideal swim segment by leveraging his superior bike performance, expertly navigating Bataan’s challenging terrain to create a decisive lead. He clinched victory with a time of 2:31:47, completing the swim in 29:03, the bike leg in 1:12:47, and the run in 47:42. Close behind was James Van Ramoga, who finished second at 2:32:58, followed by Finland’s Jamo Makelainen in third with a time of 2:41:09.\n\nIn the women’s category, Nicole Andaya dominated the field, thanks largely to an impressive 1:29:37 bike split en route to her overall finish of 2:52:53. Reflecting on the race, Andaya remarked, \"I really like the bike course because it’s uphill, and pain is part of triathlon. But when you reach the top, you see the view of the whole Bataan, which I really enjoy.\"\n\nOrganized by Sunrise Events, Inc. in partnership with FAB, the triathlon featured a 1.5-kilometer swim, a 40-kilometer cycling segment, and a 10-kilometer run. The event tested the endurance and skill of both established athletes and emerging talents on a course designed to challenge all participants.

Business

|2 min read

inDrive Philippines Anticipates Continued Growth Fueled by Low Commissions and Government Support

MANILA – inDrive Philippines is forecasting sustained expansion in its market presence, crediting its affordable commission structure for drivers and favorable regulatory environment. As of the end of October 2025, ride volume has increased by eight percent year-on-year, while passenger numbers have surged sevenfold, according to Sofia Guinto, Business Development Head for inDrive Philippines. Guinto attributed these gains to the company’s 10-percent commission fee—the lowest in the local ride-hailing sector—which incentivizes driver participation. Additionally, the app offers passengers flexibility by allowing them to select vehicles nearby based on fare and distance, enhancing user experience. The platform’s aggressive recruitment strategy has also expanded its driver base from approximately 13,000 in January to 16,000 by October. Vanessa Taqueban, Driver Operations Team Lead, expressed confidence in reaching their year-end target of 20,000 drivers. "At the start of the year, we projected 20,000 drivers by the end of 2025. With 16,000 onboard as of October, we remain on track," Taqueban said. Beyond internal initiatives, the company acknowledged the Land Transportation Franchising and Regulatory Board's (LTFRB) role in enhancing driver welfare and supporting the ride-hailing industry. Guinto also expects a 20-percent rise in demand during the Christmas season compared to November 2025 levels. Looking ahead to 2026, Guinto noted that while specific goals have yet to be unveiled, the company remains optimistic given their positive trajectory and unique market positioning. "Being a newer entrant in the sector poses challenges, but it also motivates our drivers to provide excellent service. Offering passengers greater options benefits everyone," she emphasized.

Business

|2 min read

DoubleDragon Reports Steady Net Income Amid Revenue Growth and Rising Costs in First Nine Months

DoubleDragon Corporation, led by chairmen Edgar "Injap" Sia II and Tony Tan Caktiong, posted a marginal increase in net income for the first nine months of the year despite significant revenue growth. The property developer reported a net income of P2.55 billion from January to September, reflecting a 0.7% rise from the P2.53 billion recorded in the same period last year. Consolidated revenues surged 63% year-on-year to P10.46 billion. This growth was driven by a 4.1% increase in rental revenues to P3.11 billion, attributed to higher occupancy and new tenants. Real estate sales experienced an impressive 161.2% rise, reaching P2.19 billion, largely bolstered by additional contributions from Hotel101 and residential projects. Furthermore, hotel revenues advanced 6.2% to P646.3 million, supported by improved occupancy rates across hotel properties. However, DoubleDragon’s total costs and expenses nearly doubled to P7.21 billion from P3.69 billion last year. The increase was due to higher operational expenses in real estate and hotel sectors, as well as greater administrative, interest, and marketing costs. The company currently boasts a completed recurring revenue asset portfolio spanning 1.5 million gross floor area across prime locations in Luzon, Visayas, and Mindanao. It has also expanded its presence internationally through its subsidiary, Hotel101 Global. Notably, Hotel101 Global marked a milestone by becoming the first Filipino-owned company to be listed on the US NASDAQ Stock Exchange in July, carrying a market capitalization of $1.58 billion as of November 11. The subsidiary is progressing on its inaugural overseas project in Madrid, Spain, and aims to develop one million Hotel101 rooms across more than 100 countries worldwide. In addition, DoubleDragon is advancing the growth of CentralHub’s industrial warehouse portfolio, targeting a P24.8 billion warehouse leasing portfolio and the launch of the Philippines’ first industrial REIT. CentralHub is a joint venture between DoubleDragon and Jollibee Foods Corporation, one of Asia’s leading food conglomerates.

Business

|2 min read

Ayala Corp. Expands Partnership with Thailand's CP AXTRA to Boost Retail and Investment Ventures

ACX Holdings Corp., the retail subsidiary of Ayala Corporation, has intensified its partnership with Thailand's CP AXTRA Public Co. Ltd. to jointly explore business development and investment opportunities in both the Philippine and Thai markets. The two companies formalized their expanded collaboration by signing a memorandum of understanding (MOU) on November 13, focusing on sectors such as retail, wholesale, e-commerce, and mall development. "This partnership with CP Group enables us to realize our strategy of providing Filipinos with a wider selection of global brands while showcasing Philippine businesses internationally," said Mark Robert H. Uy, Head of Corporate Strategy and Business Development at Ayala Corp. Tanit Chearavanont, Chief Wholesale Business Officer of CP AXTRA Group, expressed optimism about the alliance, stating, "We look forward to exploring investment opportunities and joint ventures within CP AXTRA’s affiliates, while strengthening management support for key projects in Thailand." The enhanced partnership signifies ACX’s growing involvement in the Philippine consumer market alongside potential ventures into Thailand. Notably, Ayala had previously announced the relaunch of Makro in the Philippines through the ACX-CP AXTRA partnership. Makro, originally a Dutch retail brand, first entered the Philippine market in 1996 via a joint venture among SHV Holdings N.V., Ayala Corp., and SM Investments Corp. SHV subsequently divested its Asian Makro operations, which have since been managed by CP AXTRA. Ayala Corporation remains one of the Philippines’ largest conglomerates, with diversified businesses spanning real estate, banking, telecommunications, renewable energy, healthcare, mobility, and logistics. The company recently reported a 96.16% year-on-year increase in its third-quarter attributable net income, surging to ₱22.91 billion from ₱11.68 billion. On November 13, shares of Ayala Corp. rose by 3.73%, equivalent to ₱15 per share, closing at ₱417. This collaboration is poised to strengthen bilateral economic ties between the Philippines and Thailand while expanding the footprint of both Ayala and CP AXTRA in the Southeast Asian retail landscape.

Business

|2 min read

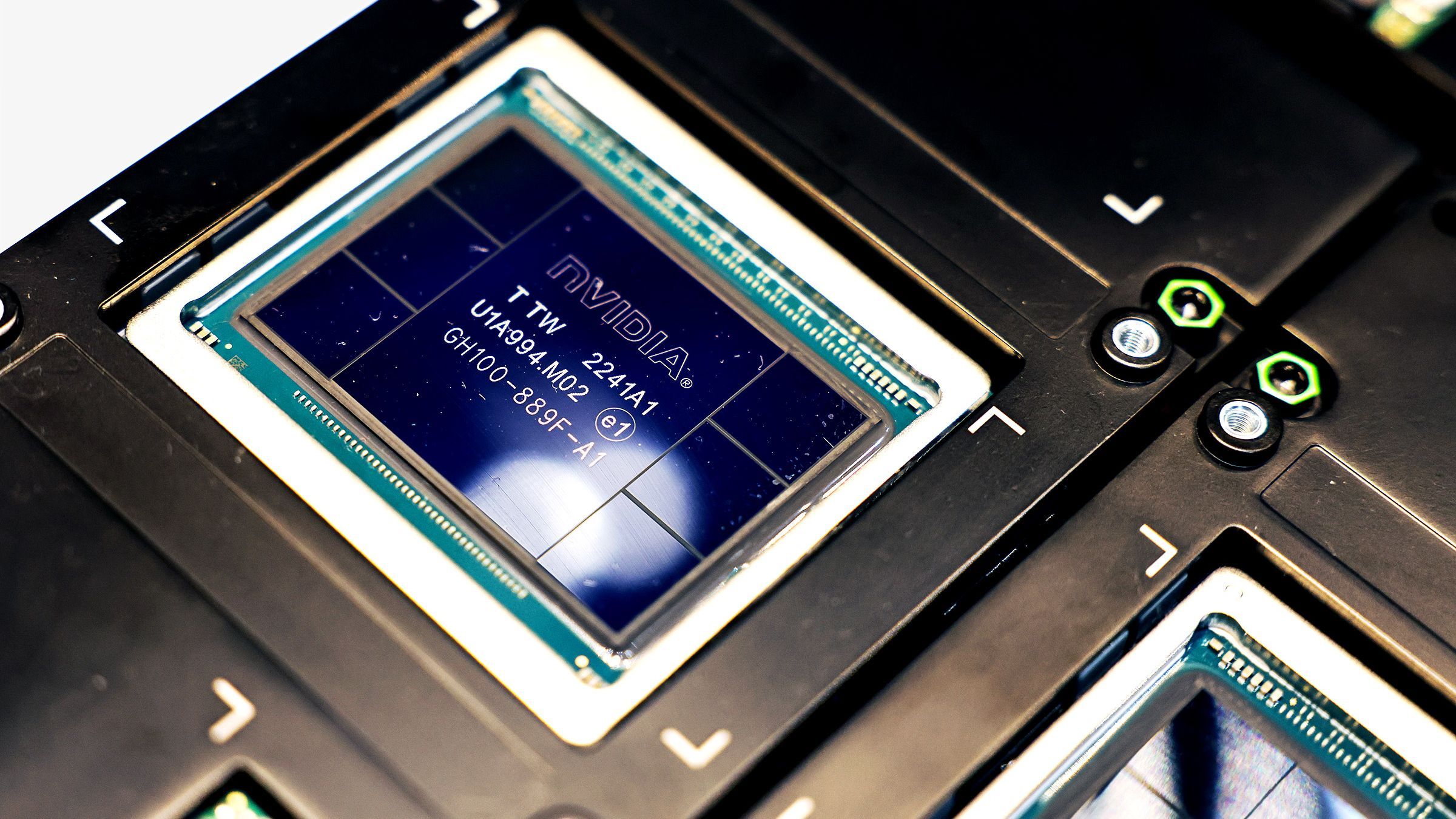

Nvidia Earnings Report to Test AI Market Optimism Amid Investor Concerns

Nvidia is set to release its latest quarterly earnings, with the report expected to provide critical insights into the health of the artificial intelligence (AI) market that has propelled the chipmaker’s stock to tremendous heights over the past three years. Despite an extraordinary 1,200% rise in Nvidia’s shares since ChatGPT’s emergence, recent market jitters and profit-taking by major investors have raised concerns about the sustainability of the AI-driven rally. Investor unease has grown as some industry leaders highlight risks associated with interdependent revenue streams among AI firms, potentially inflating valuations beyond fundamental support. Notably, tech billionaire Peter Thiel’s hedge fund has completely exited its Nvidia position, while SoftBank’s Masayoshi Son has also divested his stake but reinvested proceeds into OpenAI. Nvidia’s shares have declined nearly 8% in November amid a broader market downturn, emphasizing the high stakes tied to this earnings cycle. Brian Stutland, Chief Investment Officer at Equity Armor Investments, remarked, \"With every passing quarter, Nvidia’s earnings report becomes increasingly pivotal, offering vital signals about AI’s trajectory and enterprise spending.\" Analysts forecast a solid revenue increase of over 56% to approximately $54.9 billion for the fiscal third quarter, though this growth dwarfs the triple-digit quarterly gains Nvidia has registered in previous years. The company has consecutively outperformed expectations across 12 quarters, albeit with narrowing margins. CEO Jensen Huang recently revealed Nvidia has amassed $500 billion in chip bookings slated through 2026, underscoring sustained demand. Neil Azous, Portfolio Manager of Monopoly ETF, highlighted Nvidia’s market influence: \"The old Wall Street saying ‘one stock does not a market make’ doesn’t hold here; Nvidia effectively shapes the sector.\" Still, significant skepticism persists. Investor Michael Burry has taken a contrarian stance, betting against Nvidia by citing concerns about reported earnings being inflated through extended depreciation schedules on AI hardware. Production constraints remain a challenge. While contract manufacturer TSMC is expanding advanced chip packaging capacity to alleviate bottlenecks, Nvidia continues to introduce increasingly sophisticated hardware integrating GPUs, CPUs, networking components, and advanced cooling systems. The launch of next-generation chips like Blackwell and Rubin has also exerted pressure on profit margins. Expectations point to a slight decrease in adjusted gross margin by nearly two percentage points to around 73.6%, even as net income is projected to rise 53% to $29.54 billion. The financial community is closely monitoring Nvidia’s $100 billion investment in OpenAI and its significant stake in Intel to assess potential impacts on its balance sheet, which held $11.64 billion in cash as of late July. Geopolitical factors add complexity. U.S. export restrictions prevent Nvidia from shipping its most advanced chips to China, and CEO Huang confirmed no active negotiations are underway for selling the latest Blackwell processors there, despite speculation about a simplified version. Nvidia notably excluded China from its advanced processor sales forecast last quarter. As Nvidia reports its results, investors and analysts alike await confirmation on whether the AI investment boom will continue to justify current market valuations or if the sector faces a correction amid evolving economic and geopolitical landscapes.

Business

|3 min read

Invictus Ushers in New Leadership, Reinforces Industry Collaboration in Philippine Construction Sector

The Federation of Construction Suppliers of the Philippines, known as Invictus, recently celebrated a significant milestone with the election and induction of its inaugural officers, marking a renewed commitment to industry cooperation and sustainable growth. The event drew nearly 400 prominent figures from the construction sector, including developers, engineers, architects, and suppliers, highlighting the federation’s role as the nation’s leading construction supplier organization. Invictus Chairman Peter Mangasing emphasized the federation’s foundational ethos, stating, \"Invictus was built on the spirit of cooperation and shared success. By uniting suppliers, developers, architects, and engineers, we aim to raise industry standards, pioneer innovation, and ensure that every member is not just a participant, but a leader in their field.\" The celebration opened with traditional festivities, such as a dragon dance and a dragon eye-dotting ceremony symbolizing Invictus’ revitalized energy and vision. The night also featured a Mid-Autumn Festival-themed dice game, with nearly P2 million in prizes generously sponsored by the federation’s leading supporters. In his welcome address, Invictus President Aldrin Derrick Chua reflected on the federation’s legacy and mission: \"Around 35 years ago, the founders envisioned an organization of construction suppliers dedicated to mutual growth. That cooperative spirit inspired the revival of Invictus today. The name itself represents a philosophy of always winning, yet always humble. We are committed to working closely with industry partners and pioneering innovations in building materials to ensure every member excels as a leader.\" As the largest organization of its kind in the Philippines and a member of the Federation of Filipino Chinese Chambers of Commerce and Industry, Invictus seeks to modernize the construction industry through shared excellence, innovation, and collaboration. The induction ceremony was officiated by San Manuel, Tarlac Mayor Donya Tesoro, and attended by former Senator Cynthia Villar and Frederick Tan, COO of Megawide Construction Corporation. Villar underscored the importance of construction suppliers in national development, while Tan shared insights into Megawide’s strategic growth and stressed the need for innovation and resilience amidst evolving market challenges. \"Construction is not just about building structures—it’s about laying the foundation for progress,\" Tan remarked. An industry outlook presentation by Shiela Lobien, president of Lobien Realty Group, highlighted the resilience of the Philippine real estate and construction markets. Despite global uncertainties, the economy is projected to grow by 5–6% this year. Lobien noted increased focus on residential and mixed-use developments, along with government infrastructure initiatives and rising housing demand, particularly driven by overseas Filipino workers. \"Our finite land resources and demographic advantages continue to attract investment. The construction and supply industries are crucial to sustaining this growth momentum,\" Lobien explained. The event was a testament to camaraderie and optimism within the sector. Attendees engaged in games, shared experiences, and celebrated the collective vision of building a future defined by world-class expertise and shared progress. With its newly elected leadership and a clear, collaborative mandate, Invictus is set to strengthen its position as a key driver of innovation and excellence in the Philippine construction industry—resilient, united, and unwavering in its pursuit of success.

Business

|3 min read

SpaceX Disables Over 2,500 Starlink Devices Amid Crackdown on Myanmar Scam Centers

SpaceX has terminated service to upwards of 2,500 Starlink internet devices reportedly used by scam operations in Myanmar, as confirmed by a company executive on October 22. This development follows revelations that these terminals have been widely installed across sprawling scam compounds targeting foreigners through romance and business fraud schemes amid Myanmar’s ongoing civil conflict. These fraudulent networks have flourished along Myanmar’s loosely controlled borders, exploiting the chaos of war. A notable government crackdown that commenced in February resulted in the repatriation of approximately 7,000 workers and prompted Thailand to impose a cross-border internet blockade. Despite these measures, investigations revealed that construction of scam hubs continues unabated, with Starlink devices increasingly connecting these operations to Elon Musk’s satellite internet service. Lauren Dreyer, SpaceX’s Vice President of Starlink Business Operations, confirmed via a post on X that the company "disabled over 2,500 Starlink Kits in the vicinity of suspected 'scam centers'" within Myanmar. The exact timing of this disconnection was not specified. The online scam industry across Southeast Asia has escalated sharply, defrauding victims out of an estimated $37 billion in 2023, according to a report from the United Nations Office on Drugs and Crime. In recent actions, Cambodia deported 64 South Korean nationals accused of involvement in these scams, and Thailand’s Deputy Finance Minister Vorapak Tanyawong resigned amid allegations tying him to Cambodia-based cyber fraud networks. Myanmar’s border regions with Thailand and China have become hotbeds for these fraudulent enterprises, where some workers are trafficked or deceived, while others participate willingly. Before February, Starlink’s usage was minimal in Myanmar, but from early July through October, it ranked as the dominant internet provider according to the Asia Pacific Network Information Centre (APNIC). However, after detecting irregularities, APNIC announced plans to gradually eliminate data related to Starlink in Myanmar and 19 other countries, citing potential overestimations in usage. In recent enforcement measures, Myanmar’s military junta reported a raid on KK Park, one of the most notorious scam centers, seizing a small number of Starlink terminals. On-site witnesses described chaotic scenes as over 1,000 people fled the area following military arrival. Observers note that the junta appears to balance between suppressing these operations to appease China, which opposes the scams, and allowing militias benefiting financially from them to continue. Analysts like Nathan Ruser from the Australian Strategic Policy Institute characterize the military’s approach as largely symbolic, with minimal substantial impact. Additionally, residents near the Thai border observed KK Park to be largely deserted during the evening following the reported raid. Erin West, a former U.S. cybercrime prosecutor turned anti-scam campaigner, remarked on the limited effect of such crackdowns: "If there is a crackdown at KK Park, this is a small portion of what’s happening at KK Park. And KK Park is a small portion of the number of compounds in the world that are doing this dirty business." This latest action by SpaceX reflects growing efforts to disrupt the technological infrastructure enabling transnational scam networks in Southeast Asia, amid continued regional challenges in combating internet fraud.

Business

|3 min read

Global Reverse Stock Splits Hit Record Amid Struggles in Small-Cap Sector

Global reverse stock splits have reached unprecedented levels this year, spotlighting the difficulties small-cap companies encounter in maintaining stock exchange listings amid a booming technology sector propelled by artificial intelligence advancements. Research from Wall Street Horizon reported 288 reverse splits through October, starkly outnumbering the 53 traditional stock splits during the same period. A Reuters analysis revealed that nearly 80% of firms executing reverse splits possess market capitalizations below $250 million. These reverse splits consolidate shares to elevate stock prices, often meeting exchange listing thresholds, and are commonly interpreted as indicators of financial distress. This contrasts with traditional splits, which lower individual share prices and typically attract increased interest from retail investors. The widening disparity between reverse and traditional splits underlines a divided equity market landscape. Small-cap firms resort to financial restructuring to sustain their stock value, whereas large-cap companies, buoyed by AI innovations and increased technology investments, continue to achieve remarkable gains. Brett Mitstifer, Chief Investment Officer at Flagstar Bank, explained, \"Slower earnings growth and higher funding costs have exacerbated the problems at smaller companies.\" Small caps now constitute only 1.2% of total U.S. market capitalization, nearing a century low and significantly below the 3.6% historical average, according to Pzena Investment Management. In contrast, AI-related and major technology stocks have accounted for approximately 75% of the S&P 500's returns from November 2022—coinciding with the launch of OpenAI's ChatGPT—through September 2025, as noted by J.P. Morgan Asset Management. Leading corporations such as Apple, Amazon, Nvidia, Netflix, ServiceNow, and Walmart have executed traditional stock splits in recent years to enhance their market appeal as they expanded within the megacap sector. Christine Short, Head of Research at Wall Street Horizon, remarked, \"There’s a lot of competition among asset classes and companies. So stock splits can increase a company’s profile and bring it back into the fold.\" Retail investor interest in major technology stocks has accelerated in 2025, with investments in Netflix rising by 34% compared to the entirety of 2024. Alphabet has experienced a 19% increase in inflows, while Meta, Tesla, and Nvidia have seen respective upticks of 19%, 13%, and 10%, according to VandaTrack data.

Business

|2 min read