Business

Business

24 Jan, 2026

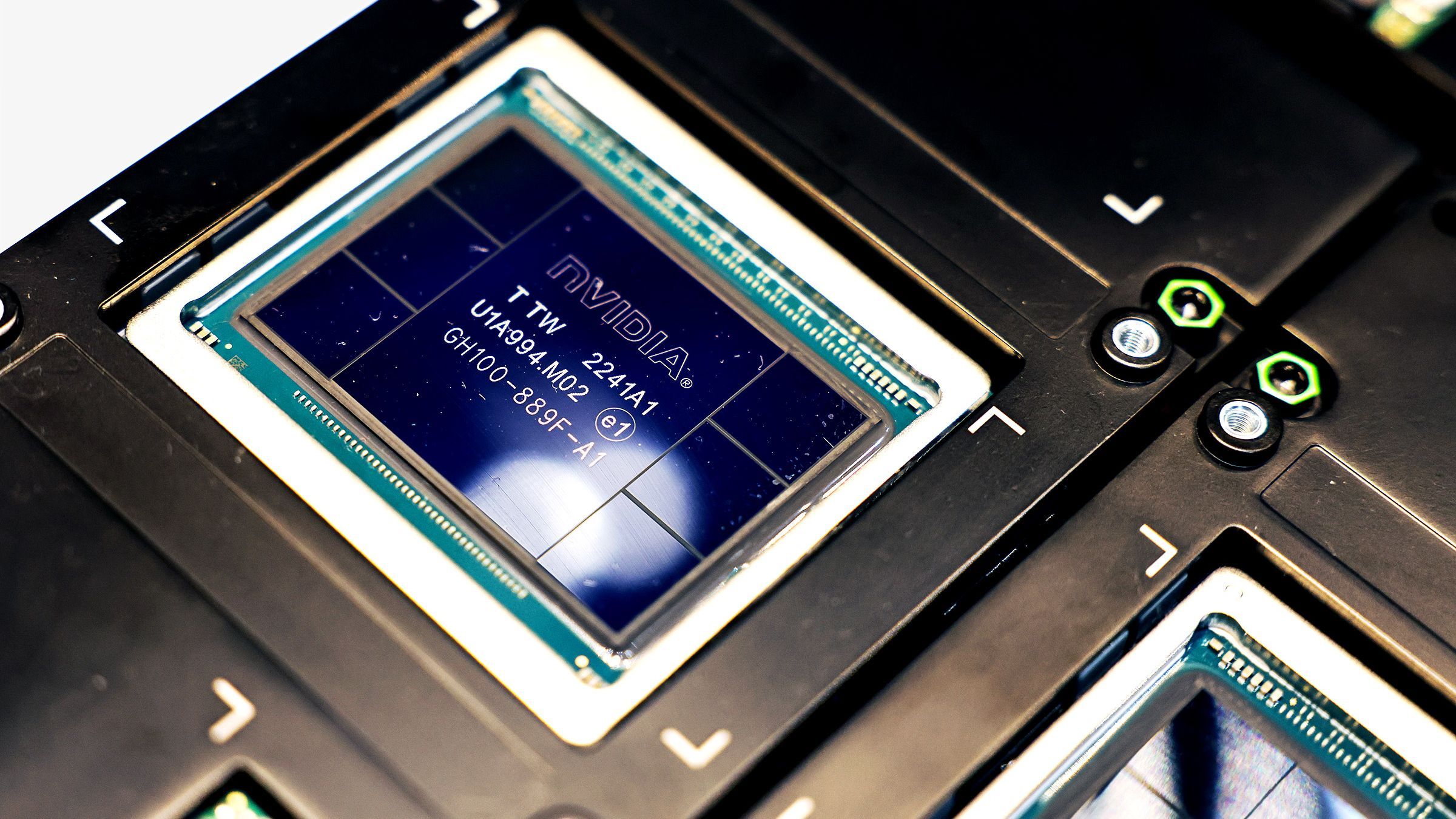

Nvidia Earnings Report to Test AI Market Optimism Amid Investor Concerns

Marciana Geronimo

Nvidia is set to release its latest quarterly earnings, with the report expected to provide critical insights into the health of the artificial intelligence (AI) market that has propelled the chipmaker’s stock to tremendous heights over the past three years. Despite an extraordinary 1,200% rise in Nvidia’s shares since ChatGPT’s emergence, recent market jitters and profit-taking by major investors have raised concerns about the sustainability of the AI-driven rally.

Investor unease has grown as some industry leaders highlight risks associated with interdependent revenue streams among AI firms, potentially inflating valuations beyond fundamental support. Notably, tech billionaire Peter Thiel’s hedge fund has completely exited its Nvidia position, while SoftBank’s Masayoshi Son has also divested his stake but reinvested proceeds into OpenAI.

Nvidia’s shares have declined nearly 8% in November amid a broader market downturn, emphasizing the high stakes tied to this earnings cycle. Brian Stutland, Chief Investment Officer at Equity Armor Investments, remarked, "With every passing quarter, Nvidia’s earnings report becomes increasingly pivotal, offering vital signals about AI’s trajectory and enterprise spending."

Analysts forecast a solid revenue increase of over 56% to approximately $54.9 billion for the fiscal third quarter, though this growth dwarfs the triple-digit quarterly gains Nvidia has registered in previous years. The company has consecutively outperformed expectations across 12 quarters, albeit with narrowing margins.

CEO Jensen Huang recently revealed Nvidia has amassed $500 billion in chip bookings slated through 2026, underscoring sustained demand. Neil Azous, Portfolio Manager of Monopoly ETF, highlighted Nvidia’s market influence: "The old Wall Street saying ‘one stock does not a market make’ doesn’t hold here; Nvidia effectively shapes the sector."

Still, significant skepticism persists. Investor Michael Burry has taken a contrarian stance, betting against Nvidia by citing concerns about reported earnings being inflated through extended depreciation schedules on AI hardware.

Production constraints remain a challenge. While contract manufacturer TSMC is expanding advanced chip packaging capacity to alleviate bottlenecks, Nvidia continues to introduce increasingly sophisticated hardware integrating GPUs, CPUs, networking components, and advanced cooling systems. The launch of next-generation chips like Blackwell and Rubin has also exerted pressure on profit margins.

Expectations point to a slight decrease in adjusted gross margin by nearly two percentage points to around 73.6%, even as net income is projected to rise 53% to $29.54 billion. The financial community is closely monitoring Nvidia’s $100 billion investment in OpenAI and its significant stake in Intel to assess potential impacts on its balance sheet, which held $11.64 billion in cash as of late July.

Geopolitical factors add complexity. U.S. export restrictions prevent Nvidia from shipping its most advanced chips to China, and CEO Huang confirmed no active negotiations are underway for selling the latest Blackwell processors there, despite speculation about a simplified version. Nvidia notably excluded China from its advanced processor sales forecast last quarter.

As Nvidia reports its results, investors and analysts alike await confirmation on whether the AI investment boom will continue to justify current market valuations or if the sector faces a correction amid evolving economic and geopolitical landscapes.

Recommended For You

Globe Telecom and Nokia Launch Ultra-Fast 5G mmWave Network in the Philippines

Jan 24, 2026

Herminio Cabanlit

Fuel Prices Set to Rise for Seventh Consecutive Week Amid Supply Challenges

Jan 24, 2026

Crispina Endaya

Bacolod City Council Upholds Traditional Betting Methods in Cockfighting

Jan 24, 2026

Perfecto Ilagan

Ombudsman to Issue Arrest Warrants for High-Profile Officials by Mid-December

Jan 24, 2026

Benilda Vergara